They need to rating a minimum of forty five per cent combination marks in their previous qualifying examination. For reserved classification students, there could possibly be some leisure inside the mixture score.

Students ought to come faraway from the course with a considerable Doing work expertise in how IP is integrated into basic and Innovative tax transactions, what are the recent areas for IP tax planning, and the way to place concerns regarding IP property in multinational organizational structures.

Having said that the ATO does undertake audits of individuals’ and companies’ tax returns to make sure that a taxpayer’s true tax affairs are regular with his/her self assessment.

Auditor: An auditor is an experienced specifically involved with taxation concerns such as collecting and reviewing audited economic information.

The goal of this system is usually to go on a ‘credit rating’ to shareholders for the tax which the company has compensated within the gains from which dividends are paid.

¹Productive application and enrollment are essential. Eligibility requirements use. Each and every establishment decides the number of credits identified by finishing this articles that will rely toward degree demands, taking into consideration any present credits maybe you have. Click a particular course for more information.

Also, students will understand the mechanics and implications of revenue and reduction allocations, liability allocations, allocations with regard to designed-in obtain property and disguised sales of property between a partner plus a partnership. Students will even have a basic understanding of partnership tax accounting, which includes building and keeping tax and book balance sheets.

The tax collector is also known as a Revenue Officer. A tax collector is accountable for checking out the economical information, possessing field audits, and preserving bookkeeping records.

Tax collector: A tax collector is liable for gathering tax. Also, They're professionals who Assemble money information, go on discipline checks for audits, evaluate money information, and manage the report book process.

This course is designed for anyone students who would like to gain a deeper understanding with the result of certain U.S. policies governing the taxation of U.S. people performing business abroad and foreign individuals doing business in The us. The course will protect a wide variety of topics with particular emphasis around the tax outcomes of cross-border reorganizations, liquidations and taxable acquisitions and dispositions.

I'm able to see that you're desperate to crack the MH CET LLB entrance exam ! Let me tell you, it's actually not nearly studying hard, but also about studying good. Very first, you need to understand the exam sample and produce a study plan that fits your needs. Focus on The real key locations like Constitutional Regulation, Contracts, and Jurisprudence. Don't just examine by your notes, but be sure to understand the concepts and may implement them. Use official study components, guides, and practice checks to help you get ready. And remember to health supplement your planning with reference books and online methods. But Here is the point: it's actually not just about the books.

DTL course is extremely helpful to get deep insights into The foundations and polices related to taxation. DTL course is really a 1-year diploma-level course that provides a basic understanding of taxation.

Tax legislation has become an ever more challenging place of practice in currently’s intricate and international regulatory setting, and Boston University School of Regulation’s Graduate Tax Application stands for the forefront of making ready legal professionals to satisfy these challenges. In fact, BU Legislation is rated #8 from the country in tax law according to

This zero-credit go/are unsuccessful course is designed to provide students with an understanding from the basic principles of finance and accounting so as check here to improve their study of tax or business law. The course is intended to provide students with little or no prior history in finance and accounting with an introduction into the core concepts, the critical vocabulary, as well as basic instruments of both of these issue spots.

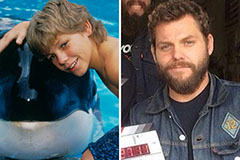

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Michelle Pfeiffer Then & Now!

Michelle Pfeiffer Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!